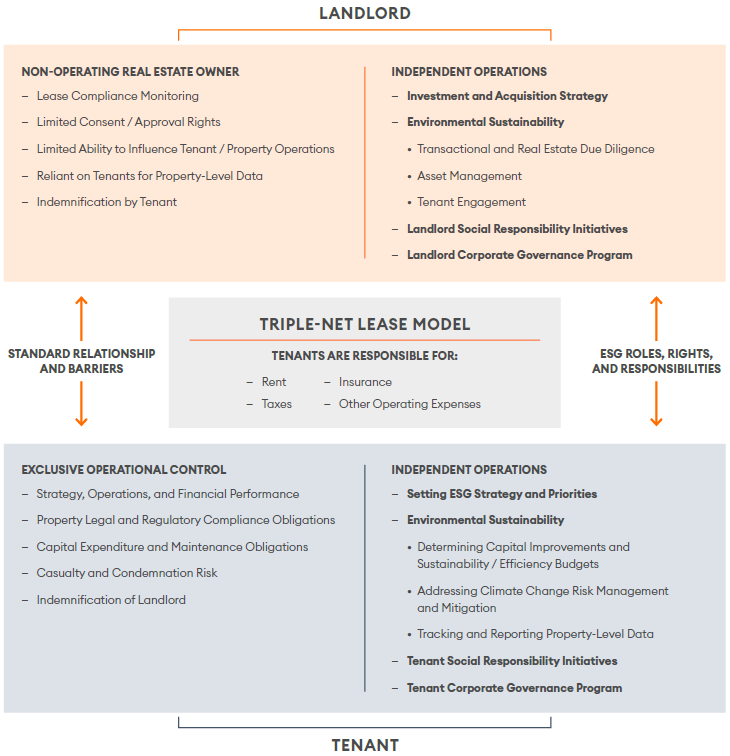

Our Triple-Net Lease Model

We are a triple net-lease real estate investment trust (REIT) that owns and leases experiential real estate assets across leading gaming, hospitality, entertainment and leisure destinations. All of our leased property portfolio is subject to long-term triple-net leases, also referred to as “NNN leases”, which generally provide that our tenants are solely responsible for management of the property and all related expenses, including taxes, insurance and maintenance, as well as other property-related expenses (such as utilities).

Our tenants’ responsibilities under these triple-net leases include operation of the business at the property as well as the maintenance, repair and improvement of the property. While the terms of our triple-net leases include conditions and requirements relating to, among other things, operating condition and maintenance, capital expenditures, and reporting that allow us to monitor and, if necessary, address significant issues at our leased properties, our tenants generally have a great deal of autonomy in operating their businesses and managing the properties subject to the leases.

In addition, due to the highly regulated nature of the gaming industry, the ownership and operation of our assets by us and our tenants, respectively, are subject to the terms of applicable gaming licenses, state and local gaming laws and gaming regulatory oversight. In particular, our ability to participate in any operational decisions is restricted by the nature and limitations of our licensure status as an owner and supplier of real estate (as contrasted with the licensure status of a gaming operator).

This is a high-level summary of general landlord and tenant ESG roles, rights, and responsibilities in a triple-net lease context and is not a summary or presentation of the terms of any specific lease.

Last updated: September 9, 2024